请输入或粘贴题目内容

搜题

请输入或粘贴题目内容

搜题

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

[主观]

At any rate I did not succeed _______ myself understood by you.A. makingB. madeC. to ma

At any rate I did not succeed _______ myself understood by you.

A. making

B. made

C. to make

D. in making

答案

答案

查看答案

更多“At any rate I did not succeed _______ myself understood by you.A. maki……”相关的问题

更多“At any rate I did not succeed _______ myself understood by you.A. maki……”相关的问题

第1题

“Did the medicine make you feel any better?”“No. I’m sorry to say that _____, the worse

“Did the medicine make you feel any better?”

“No. I’m sorry to say that _____, the worse I feel.”

A.when I take more medicine

B.taking more medicine

C.with more medicine I take

D.the more medicine I take

“Did the medicine make you feel any better?”

“No. I’m sorry to say that _____, the worse I feel.”

A.when I take more medicine

B.taking more medicine

C.with more medicine I take

D.the more medicine I take

第2题

听力原文:M: Do you have any reason to believe that your bag was stolen?W: Yes. I put it in

听力原文:M: Do you have any reason to believe that your bag was stolen?

W: Yes. I put it in the car just now, but after lunch, it was gone.

What did the woman believe?

A.She lost her bag.

B.Her bag was stolen.

C.She put her bag in the car.

听力原文:M: Do you have any reason to believe that your bag was stolen?

W: Yes. I put it in the car just now, but after lunch, it was gone.

What did the woman believe?

A.She lost her bag.

B.Her bag was stolen.

C.She put her bag in the car.

第3题

Section ADirections: In this section, you will hear 8 short conversations and 2 long conve

Section A

Directions: In this section, you will hear 8 short conversations and 2 long conversations. At the end of each conversation, one or more questions will be asked about what was said. Both the conversation and the questions will be spoken only once. After each question there will be a pause. During the pause, you must read the four choices marked A, B, C and D, and decide which is the best answer.

听力原文:W: How did you find your job? Did any of your near relatives tell you about it?

M: I looked and looked for months without finding anything. Then I saw it advertised in the paper. So I applied and got it.

Q: How did the man learn about the job?

(12)

A.He knew about it from an ad in the newspaper.

B.A close friend told him about it.

C.He heard about it from one of his relatives.

D.He saw it on a list of job openings.

Section A

Directions: In this section, you will hear 8 short conversations and 2 long conversations. At the end of each conversation, one or more questions will be asked about what was said. Both the conversation and the questions will be spoken only once. After each question there will be a pause. During the pause, you must read the four choices marked A, B, C and D, and decide which is the best answer.

听力原文:W: How did you find your job? Did any of your near relatives tell you about it?

M: I looked and looked for months without finding anything. Then I saw it advertised in the paper. So I applied and got it.

Q: How did the man learn about the job?

(12)

A.He knew about it from an ad in the newspaper.

B.A close friend told him about it.

C.He heard about it from one of his relatives.

D.He saw it on a list of job openings.

第4题

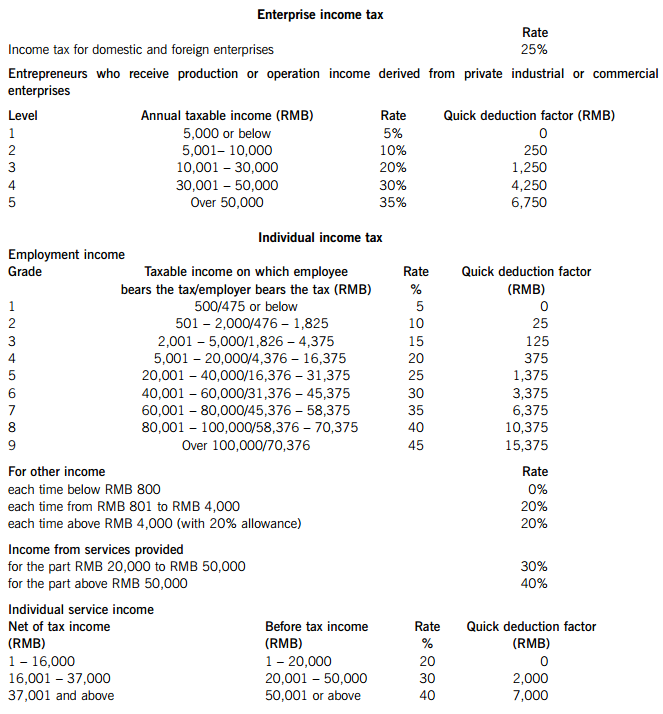

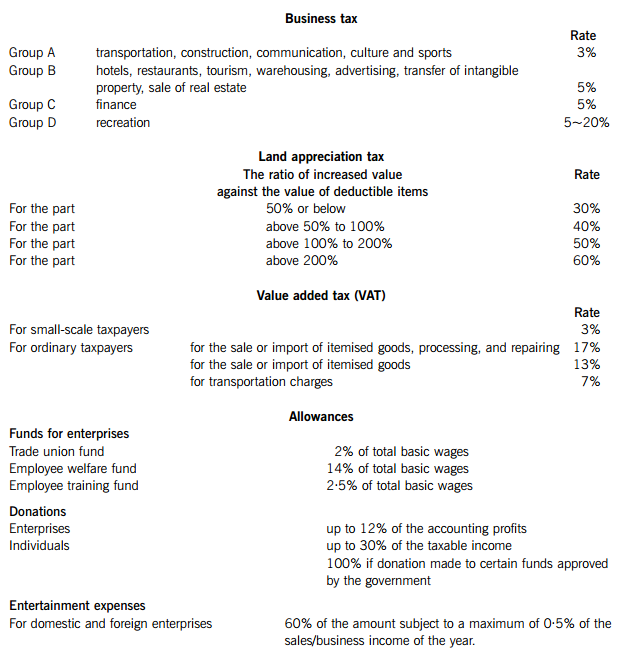

SUPPLEMENTARY INSTRUCTIONS 1. Calculations and workings need only be made to the nearest R

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. Apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

(a) The following is the statement of enterprise income tax (EIT) payable prepared by the accountant of Company P for the year 2010:

Notes:

(1) The union has not yet been set up and the expense is a general provision.

(2) The original cost of the fixed asset was RMB 150,000 and the accumulated depreciation was RMB 105,000, while the accumulated tax allowances claimed were RMB 120,000.

(3) The creditor had been liquidated three years ago.

(4) Last year (2009) was the first year a debtors provision was made. A general provision of RMB 500,000 was made but the whole amount was disallowed by the tax bureau. This year the management decided to write back part of provision amounting to RMB 150,000.

Required:

(i) Briefly comment on the correctness of the accountant’s treatment of the 12 items marked with an asterisk (*) in the income tax calculation sheet; (17 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company P for the year 2010. (6 marks)

(b) Briefly explain the term ‘arm’s length principle’ in the context of transactions between associated enterprises pursuant to the enterprise income tax law, together with the adjustment methods that may be used by the tax bureau in cases where this principle is not complied with. (6 marks)

(c) Company C, a limited company with equity of RMB 1,000,000, borrowed two loans from related companies:

– RMB 1,000,000 at a 7% annual interest rate from Company A; and

– RMB 2,000,000 at an 8% annual interest rate from Company B.

The market interest rate for the equivalent loans is a 6% annual interest rate.

In 2010, the interest paid to Company A and Company B was RMB 70,000 and RMB 160,000 respectively. The total amount of interest of RMB 230,000 was allocated RMB 140,000 to interest expense and RMB 90,000 to construction in progress in Company C’s accounts.

Required:

Calculate the amount of interest that will be disallowed for enterprise income tax under each of the account headings: interest expense and construction in progress. (6 marks)

2.

(a) Mr Y, a local Chinese national, a professional writer and artist, had the following income during 2010:

(1) Received income of RMB 45,000 for publishing the first edition of a book, and of RMB 15,000 for the second edition of the same book. The book was also published in a newspaper and he was paid RMB 5,250 for this.

(2) Sold one of his paintings for RMB 5,400.

(3) Gave a speech and was paid RMB 28,500.

(4) Acted as a translator for a movie and was paid RMB 60,000.

(5) Gave a speech in overseas country M and was paid the gross equivalent of RMB 27,000, from which the equivalent of RMB 6,750 in overseas tax was deducted at source.

(6) Sold one of his paintings in overseas country H, and was paid the gross equivalent of RMB 15,000, from which the equivalent of RMB 2,250 in overseas tax was deducted at source.

(7) Received interest of RMB 7,500 on a loan he had made to a domestic enterprise.

Required:

(i) Calculate the individual income tax (IIT) payable by Mr Y in respect of each of the items (1) to (7); (12 marks)

(ii) State how and when any IIT due on Mr Y&39;s overseas income will be reported and paid. (3 marks)

(b)

(i) State when a withholding agent must report and pay the individual income tax (IIT) deducted on a monthly basis from employment income; (1 mark)

(ii) List ANY FOUR situations in which an individual taxpayer needs to do self-reporting for IIT purposes. (4 marks)

3.

(a) Enterprise G, a general value added tax payer incorporated in Shenzhen for more than 20 years, had the following transactions in the month of May 2010. Some of the enterprises sales are subject to the standard value added tax (VAT) rate, while others are exempt (VAT) activities. All figures are stated including any applicable VAT:

(1) Sold product A (a standard VAT rate item) for RMB 400,000 and product B (a VAT exempt item) for RMB 350,000.

(2) In addition to the sales in (1) above, distributed product A with a market value of RMB 20,000 for staff welfare benefit.

(3) Purchased RMB 500,000 production materials, of which RMB 50,000 was used for a self-constructed building.

(4) Purchased RMB 200,000 agriculture product, of which RMB 20,000 was used for staff welfare benefit.

(5) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise G for the month of May 2010. (7 marks)

(b) Enterprise H, a small-scale value added tax payer, had the following transactions in the month of May 2010. All figures are stated including VAT:

(1) Sold product for RMB 20,000.

(2) Purchased RMB 500,000 of production materials.

(3) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise H on each of the above transactions, giving brief explanations of their treatment. (4 marks)

(c) Company X, a property developer, had the following transactions in 2010:

(1) Donated a new building to a high school. The cost of construction of the building was RMB 500,000 and the deemed profit rate is 10%.

(2) Contributed an office building as part of a capital contribution. The cost of the building was RMB 600,000 and the market value RMB 800,000.

(3) Sold an equity holding of unlisted stock for RMB 900,000. The equity holding had been obtained by the contribution of a factory building by Company X which had cost RMB 300,000.

(4) Obtained a six-month bank loan of RMB 2,000,000 from 1 July 2010 with the pledge of a shop owned by the company. During the loan period, the bank did not charge any interest, but instead the bank had the right to use the shop rent free. The market interest rate for a similar loan is 6% per year. At the end of the loan period, Company X sold the shop for a price which gave it RMB 1,000,000 more than the amount needed to repay the bank loan.

Required:

Calculate the business tax (BT) payable by Company X as a result of each of the above transactions (1) to (4), giving brief explanations of their treatment. (6 marks)

(d) State the THREE conditions that must be met for a transportation fee paid by the seller to be excluded from the sale consideration for the purposes of value added tax (VAT). (3 marks)

4.

(a) Company K carried out the following transactions:

(1) Imported a vehicle costing RMB 300,000 and paid transportation costs of USD 10,000 for the journey from the overseas supplier to the port in China.

(2) Shipped a machine with a value of RMB 500,000 overseas for repair and paid for materials of USD 10,000 and a repairing fee of USD 30,000. The machine was shipped back to China in the same month.

(3) Subcontracted some domestic raw materials valued at RMB 200,000 to an overseas company. The related fee and transportation costs were USD 100,000 and USD 20,000 respectively.

(4) Imported raw materials costing RMB 30,000,000 and paid transportation costs of USD 50,000 for the journey from the overseas supplier to the port in China. After the arrival of the materials, Company K discovered that 20% of the materials had a quality problem. The supplier agreed to ship a further 20% replacement materials at no cost to Company K in the same month. Both parties agreed that the quality problem goods should be kept in China.

Required:

Calculate the customs tariff, consumption tax (CT) and value added tax (VAT) payable by Company K as a result of each of the above transactions.

Note: for the purposes of your calculations you should assume that:

(1) The customs tariff for all kinds of imported goods is 20%.

(2) The rate of consumption tax (CT) is 10%.

(3) The USD:RMB exchange rate is 1:6·6

(b) Briefly explain the procedures, including any time limits, for the declaration and payment of the customs

5.

Briefly explain the consequences of the following actions, including any fines or other penalty that may be imposed:

(a) Failure to keep or maintain proper accounting records/vouchers. (2 marks)

(b) Failure to file a return within the prescribed time limit. (2 marks)

(c) Failure to file a return and hence not paying or paying less tax than is duly payable. (1 mark)

(d) Failure to pay tax by concealment of property. (3 marks)

(e) Refusal to pay tax by violence or menace. (2 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

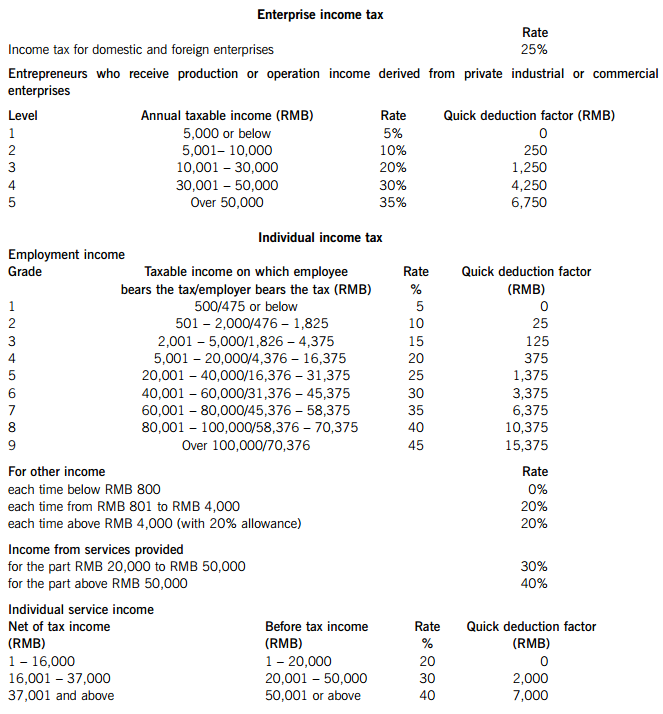

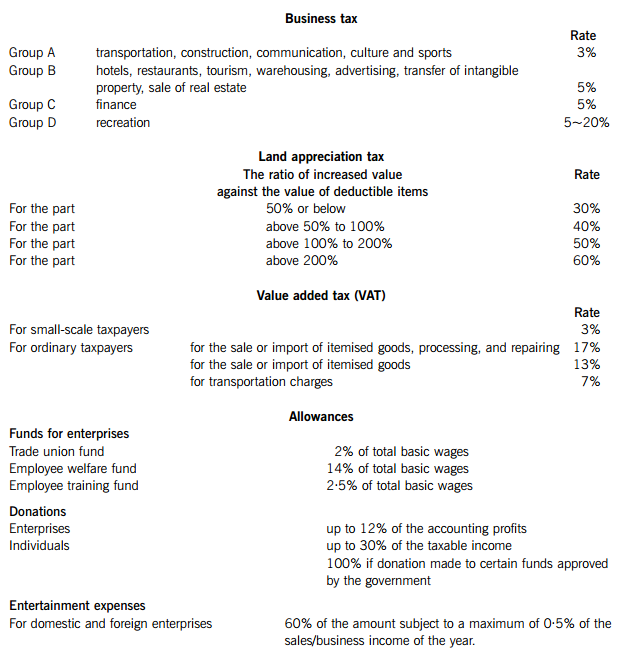

SUPPLEMENTARY INSTRUCTIONS

1. Calculations and workings need only be made to the nearest RMB.

2. Apportionments should be made to the nearest month.

3. All workings should be shown.

TAX RATES AND ALLOWANCES

The following tax rates and allowances are to be used in answering the questions.

1.

(a) The following is the statement of enterprise income tax (EIT) payable prepared by the accountant of Company P for the year 2010:

Notes:

(1) The union has not yet been set up and the expense is a general provision.

(2) The original cost of the fixed asset was RMB 150,000 and the accumulated depreciation was RMB 105,000, while the accumulated tax allowances claimed were RMB 120,000.

(3) The creditor had been liquidated three years ago.

(4) Last year (2009) was the first year a debtors provision was made. A general provision of RMB 500,000 was made but the whole amount was disallowed by the tax bureau. This year the management decided to write back part of provision amounting to RMB 150,000.

Required:

(i) Briefly comment on the correctness of the accountant’s treatment of the 12 items marked with an asterisk (*) in the income tax calculation sheet; (17 marks)

(ii) Calculate the correct amount of enterprise income tax (EIT) payable by Company P for the year 2010. (6 marks)

(b) Briefly explain the term ‘arm’s length principle’ in the context of transactions between associated enterprises pursuant to the enterprise income tax law, together with the adjustment methods that may be used by the tax bureau in cases where this principle is not complied with. (6 marks)

(c) Company C, a limited company with equity of RMB 1,000,000, borrowed two loans from related companies:

– RMB 1,000,000 at a 7% annual interest rate from Company A; and

– RMB 2,000,000 at an 8% annual interest rate from Company B.

The market interest rate for the equivalent loans is a 6% annual interest rate.

In 2010, the interest paid to Company A and Company B was RMB 70,000 and RMB 160,000 respectively. The total amount of interest of RMB 230,000 was allocated RMB 140,000 to interest expense and RMB 90,000 to construction in progress in Company C’s accounts.

Required:

Calculate the amount of interest that will be disallowed for enterprise income tax under each of the account headings: interest expense and construction in progress. (6 marks)

2.

(a) Mr Y, a local Chinese national, a professional writer and artist, had the following income during 2010:

(1) Received income of RMB 45,000 for publishing the first edition of a book, and of RMB 15,000 for the second edition of the same book. The book was also published in a newspaper and he was paid RMB 5,250 for this.

(2) Sold one of his paintings for RMB 5,400.

(3) Gave a speech and was paid RMB 28,500.

(4) Acted as a translator for a movie and was paid RMB 60,000.

(5) Gave a speech in overseas country M and was paid the gross equivalent of RMB 27,000, from which the equivalent of RMB 6,750 in overseas tax was deducted at source.

(6) Sold one of his paintings in overseas country H, and was paid the gross equivalent of RMB 15,000, from which the equivalent of RMB 2,250 in overseas tax was deducted at source.

(7) Received interest of RMB 7,500 on a loan he had made to a domestic enterprise.

Required:

(i) Calculate the individual income tax (IIT) payable by Mr Y in respect of each of the items (1) to (7); (12 marks)

(ii) State how and when any IIT due on Mr Y&39;s overseas income will be reported and paid. (3 marks)

(b)

(i) State when a withholding agent must report and pay the individual income tax (IIT) deducted on a monthly basis from employment income; (1 mark)

(ii) List ANY FOUR situations in which an individual taxpayer needs to do self-reporting for IIT purposes. (4 marks)

3.

(a) Enterprise G, a general value added tax payer incorporated in Shenzhen for more than 20 years, had the following transactions in the month of May 2010. Some of the enterprises sales are subject to the standard value added tax (VAT) rate, while others are exempt (VAT) activities. All figures are stated including any applicable VAT:

(1) Sold product A (a standard VAT rate item) for RMB 400,000 and product B (a VAT exempt item) for RMB 350,000.

(2) In addition to the sales in (1) above, distributed product A with a market value of RMB 20,000 for staff welfare benefit.

(3) Purchased RMB 500,000 production materials, of which RMB 50,000 was used for a self-constructed building.

(4) Purchased RMB 200,000 agriculture product, of which RMB 20,000 was used for staff welfare benefit.

(5) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise G for the month of May 2010. (7 marks)

(b) Enterprise H, a small-scale value added tax payer, had the following transactions in the month of May 2010. All figures are stated including VAT:

(1) Sold product for RMB 20,000.

(2) Purchased RMB 500,000 of production materials.

(3) Purchased a production machine for RMB 100,000 and sold a used machine for RMB 10,000. The used machine had been bought in May 2009 and used by the enterprise ever since then.

Required:

Calculate the value added tax (VAT) payable by Enterprise H on each of the above transactions, giving brief explanations of their treatment. (4 marks)

(c) Company X, a property developer, had the following transactions in 2010:

(1) Donated a new building to a high school. The cost of construction of the building was RMB 500,000 and the deemed profit rate is 10%.

(2) Contributed an office building as part of a capital contribution. The cost of the building was RMB 600,000 and the market value RMB 800,000.

(3) Sold an equity holding of unlisted stock for RMB 900,000. The equity holding had been obtained by the contribution of a factory building by Company X which had cost RMB 300,000.

(4) Obtained a six-month bank loan of RMB 2,000,000 from 1 July 2010 with the pledge of a shop owned by the company. During the loan period, the bank did not charge any interest, but instead the bank had the right to use the shop rent free. The market interest rate for a similar loan is 6% per year. At the end of the loan period, Company X sold the shop for a price which gave it RMB 1,000,000 more than the amount needed to repay the bank loan.

Required:

Calculate the business tax (BT) payable by Company X as a result of each of the above transactions (1) to (4), giving brief explanations of their treatment. (6 marks)

(d) State the THREE conditions that must be met for a transportation fee paid by the seller to be excluded from the sale consideration for the purposes of value added tax (VAT). (3 marks)

4.

(a) Company K carried out the following transactions:

(1) Imported a vehicle costing RMB 300,000 and paid transportation costs of USD 10,000 for the journey from the overseas supplier to the port in China.

(2) Shipped a machine with a value of RMB 500,000 overseas for repair and paid for materials of USD 10,000 and a repairing fee of USD 30,000. The machine was shipped back to China in the same month.

(3) Subcontracted some domestic raw materials valued at RMB 200,000 to an overseas company. The related fee and transportation costs were USD 100,000 and USD 20,000 respectively.

(4) Imported raw materials costing RMB 30,000,000 and paid transportation costs of USD 50,000 for the journey from the overseas supplier to the port in China. After the arrival of the materials, Company K discovered that 20% of the materials had a quality problem. The supplier agreed to ship a further 20% replacement materials at no cost to Company K in the same month. Both parties agreed that the quality problem goods should be kept in China.

Required:

Calculate the customs tariff, consumption tax (CT) and value added tax (VAT) payable by Company K as a result of each of the above transactions.

Note: for the purposes of your calculations you should assume that:

(1) The customs tariff for all kinds of imported goods is 20%.

(2) The rate of consumption tax (CT) is 10%.

(3) The USD:RMB exchange rate is 1:6·6

(b) Briefly explain the procedures, including any time limits, for the declaration and payment of the customs

5.

Briefly explain the consequences of the following actions, including any fines or other penalty that may be imposed:

(a) Failure to keep or maintain proper accounting records/vouchers. (2 marks)

(b) Failure to file a return within the prescribed time limit. (2 marks)

(c) Failure to file a return and hence not paying or paying less tax than is duly payable. (1 mark)

(d) Failure to pay tax by concealment of property. (3 marks)

(e) Refusal to pay tax by violence or menace. (2 marks)

请帮忙给出每个问题的正确答案和分析,谢谢!

第6题

Mr. Richards worked in a shop which sold, cleaned and repaired hearing-aids(助听器).

Mr. Richards worked in a shop which sold, cleaned and repaired hearing-aids(助听器). One day an old gentleman entered and put one down in front of him without saying a word.

"What's the matter with it?" Mr. Richards said. The man did not answer. Of course Mr. Richards thought that the man must be deaf and that his hearing-aid must be faulty, so he said again, more loudly, 'What's wrong with your hearing-aid, sir?' again the man said nothing, so Mr. Richards shouted his question again as loudly as he could.

The man then took a pen and a piece of paper and wrote: "It isn't necessary to shout when you're speaking to me. My ears are as good as yours. This hearing-aid is my wife's, not mine. I've just had a throat operation, and my problem is not that I can't hear, but that I can't speak."

1)、An old gentleman bring a hearing-aid to Mr. Richards one day.

A.T

B.F

2)、Mr. Richards thought the old man was a deaf.

A.T

B.F

3)、The old man shouted as loudly as he could to make Mr. Richards understand what he wanted.

A.T

B.F

4)、The old man was too angry to speak any more to Mr. Richards.

A.T

B.F

5)、The story takes place in a hospital.

A.T

B.F

Mr. Richards worked in a shop which sold, cleaned and repaired hearing-aids(助听器). One day an old gentleman entered and put one down in front of him without saying a word.

"What's the matter with it?" Mr. Richards said. The man did not answer. Of course Mr. Richards thought that the man must be deaf and that his hearing-aid must be faulty, so he said again, more loudly, 'What's wrong with your hearing-aid, sir?' again the man said nothing, so Mr. Richards shouted his question again as loudly as he could.

The man then took a pen and a piece of paper and wrote: "It isn't necessary to shout when you're speaking to me. My ears are as good as yours. This hearing-aid is my wife's, not mine. I've just had a throat operation, and my problem is not that I can't hear, but that I can't speak."

1)、An old gentleman bring a hearing-aid to Mr. Richards one day.

A.T

B.F

2)、Mr. Richards thought the old man was a deaf.

A.T

B.F

3)、The old man shouted as loudly as he could to make Mr. Richards understand what he wanted.

A.T

B.F

4)、The old man was too angry to speak any more to Mr. Richards.

A.T

B.F

5)、The story takes place in a hospital.

A.T

B.F

第7题

The job was done, and it was time for a last cigarette. Eddie began tapping the pockets of his overalls, looking for the new packet of Marlboro he bought that morning. It was not there.

It was as he swung around to look in his toolbox for the cigarettes that Eddie saw the lump. Right in the middle of the brand new bright red carpet, there was a lump. A lump the size of a packet of cigarettes.

"I've done it again? said Eddie angrily. "I've left the cigarettes under the carpet?

He had done this once before, and taking up and refitting the carpet had taken him two hours. Eddie was determined that he was not going to spend another two hours in this house. He decided to get rid of the lump another way. It would mean wasting a good packet of cigarettes, nearly full, but anything was better than taking up the whole carpet and fitting it again .He turned to his toolbox for a large hammer.

Eddie didn't want to damage the carpet itself, so he took a block of wood and placed it on top of the lump. Then he began to beat the block of wood as hard as he could. He kept beating, hoping Mrs. Vanbrugh wouldn't hear the noise and come to see what he was doing. It would be difficult to explain why he was hammering the middle of her beautiful new carpet... The lump was beginning to flatten out.

After three or four minutes, the job was finally finished. Eddie picked up his tools, and began to walk out to his car. Mrs. Vanbrugh accompanied him. She seemed a little worried about something.

"Young man, while you were working today, you didn't by any chance see any sign of Armand, did you? Armand is my bird. I let him out of his cage, you see, this morning, and he's disappeared. He likes to walk around the house, and he usually just comes back to his cage after an hour or so and gets right in. Only today he didn't come back. He's never done such a thing before, it's most peculiar..."

"No, madam, I haven't seen him anywhere," said Eddie, as he reached to start the car.

And he saw his packet of Marlboro cigarettes on the panel, where he had left it at lunchtime....

And he remembered the lump in the carpet...

What did Eddie want to do when he had finished fitting the carpet?

A.To have a cigarette.

B.To hammer the carpet flat.

C.To put back his tools.

D.To start work in the dining room.

It was as he swung around to look in his toolbox for the cigarettes that Eddie saw the lump. Right in the middle of the brand new bright red carpet, there was a lump. A lump the size of a packet of cigarettes.

"I've done it again? said Eddie angrily. "I've left the cigarettes under the carpet?

He had done this once before, and taking up and refitting the carpet had taken him two hours. Eddie was determined that he was not going to spend another two hours in this house. He decided to get rid of the lump another way. It would mean wasting a good packet of cigarettes, nearly full, but anything was better than taking up the whole carpet and fitting it again .He turned to his toolbox for a large hammer.

Eddie didn't want to damage the carpet itself, so he took a block of wood and placed it on top of the lump. Then he began to beat the block of wood as hard as he could. He kept beating, hoping Mrs. Vanbrugh wouldn't hear the noise and come to see what he was doing. It would be difficult to explain why he was hammering the middle of her beautiful new carpet... The lump was beginning to flatten out.

After three or four minutes, the job was finally finished. Eddie picked up his tools, and began to walk out to his car. Mrs. Vanbrugh accompanied him. She seemed a little worried about something.

"Young man, while you were working today, you didn't by any chance see any sign of Armand, did you? Armand is my bird. I let him out of his cage, you see, this morning, and he's disappeared. He likes to walk around the house, and he usually just comes back to his cage after an hour or so and gets right in. Only today he didn't come back. He's never done such a thing before, it's most peculiar..."

"No, madam, I haven't seen him anywhere," said Eddie, as he reached to start the car.

And he saw his packet of Marlboro cigarettes on the panel, where he had left it at lunchtime....

And he remembered the lump in the carpet...

What did Eddie want to do when he had finished fitting the carpet?

A.To have a cigarette.

B.To hammer the carpet flat.

C.To put back his tools.

D.To start work in the dining room.

第8题

My father was, I am sure, intended by nature to be a cheerful kindly man. Until be was thirty-four years old he worked as a farmhand for a man named Thomas Butterworth whose place lay near the town of Bidwell, Ohio. He had a horse of his own, and on Saturday evenings drove into town to spend a few hours in social intercourse with other farmhands. In town he drank several glasses of beer and stood about in Ben Head's saloon—crowded on Saturday evening with visiting farmhands. Songs were sung and glasses thumped on the bar. At ten o'clock father drove home along a lonely country road, made his horse comfortable for the night, and himself went to bed, quite happy in his position in life. He had at that time no notion of trying to rise in the world.

It was in the spring of his thirty-fifth year that father married my mother, then a country school teacher, and in the following spring I came wriggling and crying into the world. Something happened to the two people. They became ambitious. The American idea of getting up in the world took possession of them.

It may have been that mother was responsible. Being a school teacher, she had no doubt read books and magazines. She had, I presume, read of how Garfield, Lincoln, and other Americans rose from poverty to fame and greatness, and as I lay beside her—in the days of her lying-in—she may have dreamed that I would someday rule men and cities. At any rate she induced father to give up his place as farmhand, sell his horse, and embark on an independent enterprise of his own. She was a tall silent woman with a long nose and troubled gray eyes. For herself she wanted nothing. For father and me she was incurably ambitious.

According to the narrator, his father's life used to be______.

A.quite poor

B.quite hard

C.quite happy

D.quite rich

It was in the spring of his thirty-fifth year that father married my mother, then a country school teacher, and in the following spring I came wriggling and crying into the world. Something happened to the two people. They became ambitious. The American idea of getting up in the world took possession of them.

It may have been that mother was responsible. Being a school teacher, she had no doubt read books and magazines. She had, I presume, read of how Garfield, Lincoln, and other Americans rose from poverty to fame and greatness, and as I lay beside her—in the days of her lying-in—she may have dreamed that I would someday rule men and cities. At any rate she induced father to give up his place as farmhand, sell his horse, and embark on an independent enterprise of his own. She was a tall silent woman with a long nose and troubled gray eyes. For herself she wanted nothing. For father and me she was incurably ambitious.

According to the narrator, his father's life used to be______.

A.quite poor

B.quite hard

C.quite happy

D.quite rich

第9题

In the past,I always thought being a teacher was an easy job. But I changed my ___36___when I became a part-time teacher. About four years ago. Richard asked me if I could help teach his students how to ___37___a web site about themselves. I agreed to do it because computer is what I do well and I didn’tthink that teaching computer would be that ___38___ During the first few lessons,I tried my best to be friends with the students but in the end I knew that it didn’t really ___39 ___They tried to play with me all the time even when they were supposed to be learning. I didn’tmind ___40___they played with me after the lessons. But when they did it during the lesson, I wouldn’t be ___41___to teach them. My experience has helped me ___42___teachers more. Also it Has made me be a better teacher because I now know how teachers feel. If any of my ___43___teachers are reading this,I want to ___44___sorry if I sometimes played around in the class while you were teaching.I never thought how that would make you feel. I___45___I will do my best to be a good student in the future.

36、36()

A.brain

B.heart

C.mind

D.sight

39()A.differ

B.develop

C.exist

D.work

40()A.if

B.how

C.where

D.why

42 ()A.bear

B.notice

C.serve

D.understand

44()A.talk

B.tell

C.say

D.speak

45()A.advice

B.promise

C.advise

D.suggest

38 ()A.hard

B.simple

C.important

D.attractive

41()A.sure

B.able

C.liable

D.righ

43()A.new

B.past

C.future

D.current

37()A.find

B.link

C.make

D.repai

请帮忙给出每个问题的正确答案和分析,谢谢!

36、36()

A.brain

B.heart

C.mind

D.sight

39()A.differ

B.develop

C.exist

D.work

40()A.if

B.how

C.where

D.why

42 ()A.bear

B.notice

C.serve

D.understand

44()A.talk

B.tell

C.say

D.speak

45()A.advice

B.promise

C.advise

D.suggest

38 ()A.hard

B.simple

C.important

D.attractive

41()A.sure

B.able

C.liable

D.righ

43()A.new

B.past

C.future

D.current

37()A.find

B.link

C.make

D.repai

请帮忙给出每个问题的正确答案和分析,谢谢!

第10题

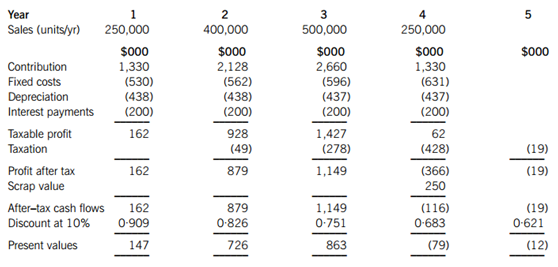

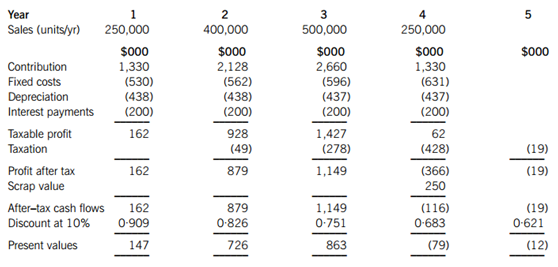

The following draft appraisal of a proposed investment project has been prepared for the fi nance director of OKM Co by a trainee accountant. The project is consistent with the current business operations of OKM Co.

Net present value = 1,645,000 – 2,000,000 = ($355,000) so reject the project.

The following information was included with the draft investment appraisal:

1. The initial investment is $2 million

2. Selling price: $12/unit (current price terms), selling price infl ation is 5% per year

3. Variable cost: $7/unit (current price terms), variable cost infl ation is 4% per year

4. Fixed overhead costs: $500,000/year (current price terms), fi xed cost infl ation is 6% per year

5. $200,000/year of the fi xed costs are development costs that have already been incurred and are being recovered by an annual charge to the project

6. Investment fi nancing is by a $2 million loan at a fi xed interest rate of 10% per year

7. OKM Co can claim 25% reducing balance capital allowances on this investment and pays taxation one year in arrears at a rate of 30% per year

8. The scrap value of machinery at the end of the four-year project is $250,000

9. The real weighted average cost of capital of OKM Co is 7% per year

10. The general rate of infl ation is expected to be 4?7% per year

Required:

(a) Identify and comment on any errors in the investment appraisal prepared by the trainee accountant. (5 marks)

(b) Prepare a revised calculation of the net present value of the proposed investment project and comment on the project’s acceptability. (12 marks)

(c) Discuss the problems faced when undertaking investment appraisal in the following areas and comment on how these problems can be overcome:

(i) assets with replacement cycles of different lengths;

(ii) an investment project has several internal rates of return;

(iii) the business risk of an investment project is signifi cantly different from the business risk of current operations. (8 marks)

请帮忙给出正确答案和分析,谢谢!

Net present value = 1,645,000 – 2,000,000 = ($355,000) so reject the project.

The following information was included with the draft investment appraisal:

1. The initial investment is $2 million

2. Selling price: $12/unit (current price terms), selling price infl ation is 5% per year

3. Variable cost: $7/unit (current price terms), variable cost infl ation is 4% per year

4. Fixed overhead costs: $500,000/year (current price terms), fi xed cost infl ation is 6% per year

5. $200,000/year of the fi xed costs are development costs that have already been incurred and are being recovered by an annual charge to the project

6. Investment fi nancing is by a $2 million loan at a fi xed interest rate of 10% per year

7. OKM Co can claim 25% reducing balance capital allowances on this investment and pays taxation one year in arrears at a rate of 30% per year

8. The scrap value of machinery at the end of the four-year project is $250,000

9. The real weighted average cost of capital of OKM Co is 7% per year

10. The general rate of infl ation is expected to be 4?7% per year

Required:

(a) Identify and comment on any errors in the investment appraisal prepared by the trainee accountant. (5 marks)

(b) Prepare a revised calculation of the net present value of the proposed investment project and comment on the project’s acceptability. (12 marks)

(c) Discuss the problems faced when undertaking investment appraisal in the following areas and comment on how these problems can be overcome:

(i) assets with replacement cycles of different lengths;

(ii) an investment project has several internal rates of return;

(iii) the business risk of an investment project is signifi cantly different from the business risk of current operations. (8 marks)

请帮忙给出正确答案和分析,谢谢!

大学生认证

大学生认证