请输入或粘贴题目内容

搜题

请输入或粘贴题目内容

搜题

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

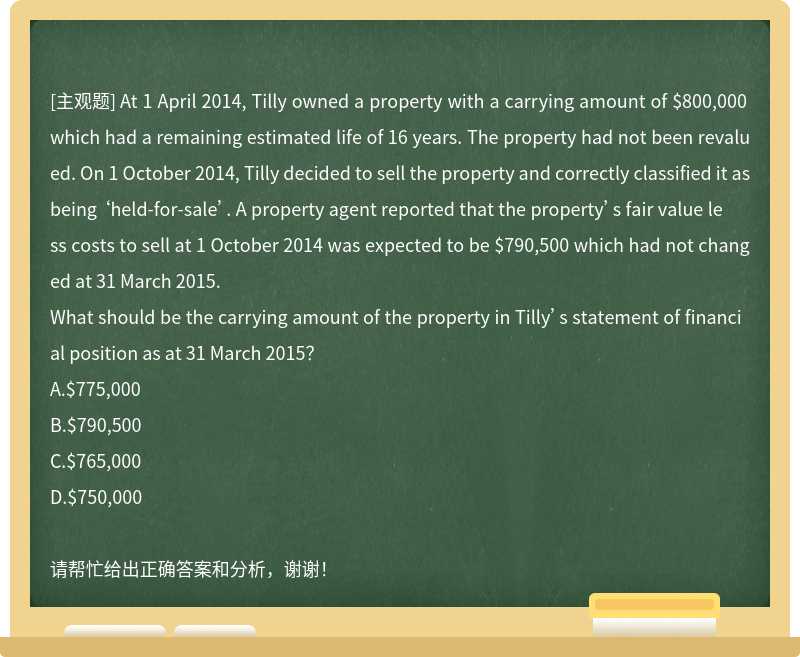

[主观]

At 1 April 2014, Tilly owned a property with a carrying amount of $800,000 which had a remaining estimated life of 16 years. The property had not been revalued. On 1 October 2014, Tilly decided to sell the property and correctly classified it as being ‘held-for-sale’. A property agent reported that the property’s fair value less costs to sell at 1 October 2014 was expected to be $790,500 which had not changed at 31 March 2015.

What should be the carrying amount of the property in Tilly’s statement of financial position as at 31 March 2015?

A.$775,000

B.$790,500

C.$765,000

D.$750,000

请帮忙给出正确答案和分析,谢谢!

答案

答案

查看答案

更多“At 1 April 2014, Tilly owned a property with a carrying amount of $800……”相关的问题

更多“At 1 April 2014, Tilly owned a property with a carrying amount of $800……”相关的问题

第1题

Wilmslow acquired 80% of the equity shares of Zeta on 1 April 2014 when Zeta’s retained earnings were $200,000. During the year ended 31 March 2015, Zeta purchased goods from Wilmslow totalling $320,000. At 31 March 2015, one quarter of these goods were still in the inventory of Zeta. Wilmslow applies a mark-up on cost of 25% to all of its sales.

At 31 March 2015, the retained earnings of Wilmslow and Zeta were $450,000 and $340,000 respectively.

What would be the amount of retained earnings in Wilmslow’s consolidated statement of financial position as at 31 March 2015?

A.$706,000

B.$542,000

C.$498,000

D.$546,000

请帮忙给出正确答案和分析,谢谢!

At 31 March 2015, the retained earnings of Wilmslow and Zeta were $450,000 and $340,000 respectively.

What would be the amount of retained earnings in Wilmslow’s consolidated statement of financial position as at 31 March 2015?

A.$706,000

B.$542,000

C.$498,000

D.$546,000

请帮忙给出正确答案和分析,谢谢!

第2题

You are the audit supervisor of Maple & Co and are currently planning the audit of an existing client, Sycamore Science Co (Sycamore), whose year end was 30 April 2015. Sycamore is a pharmaceutical company, which manufactures and supplies a wide range of medical supplies. The draft financial statements show revenue of $35·6 million and profit before tax of $5·9 million.

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

请帮忙给出正确答案和分析,谢谢!

Sycamore’s previous finance director left the company in December 2014 after it was discovered that he had been claiming fraudulent expenses from the company for a significant period of time. A new finance director was appointed in January 2015 who was previously a financial controller of a bank, and she has expressed surprise that Maple & Co had not uncovered the fraud during last year’s audit.

During the year Sycamore has spent $1·8 million on developing several new products. These projects are at different stages of development and the draft financial statements show the full amount of $1·8 million within intangible assets. In order to fund this development, $2·0 million was borrowed from the bank and is due for repayment over a ten-year period. The bank has attached minimum profit targets as part of the loan covenants.

The new finance director has informed the audit partner that since the year end there has been an increased number of sales returns and that in the month of May over $0·5 million of goods sold in April were returned.

Maple & Co attended the year-end inventory count at Sycamore’s warehouse. The auditor present raised concerns that during the count there were movements of goods in and out the warehouse and this process did not seem well controlled.

During the year, a review of plant and equipment in the factory was undertaken and surplus plant was sold, resulting in a profit on disposal of $210,000.

Required:

(a) State Maples & Co’s responsibilities in relation to the prevention and detection of fraud and error. (4 marks)

(b) Describe SIX audit risks, and explain the auditor’s response to each risk, in planning the audit of Sycamore Science Co. (12 marks)

(c) Sycamore’s new finance director has read about review engagements and is interested in the possibility of Maple & Co undertaking these in the future. However, she is unsure how these engagements differ from an external audit and how much assurance would be gained from this type of engagement.

Required:

(i) Explain the purpose of review engagements and how these differ from external audits; and (2 marks)

(ii) Describe the level of assurance provided by external audits and review engagements. (2 marks)

请帮忙给出正确答案和分析,谢谢!

第3题

Please answer, fill in the blanks or make choice of the following questions. Exchange for GBP5, 000

Please answer, fill in the blanks or make choice of the following questions.

Exchange for GBP5, 000. 00 London, 1 April, 200×

At 60 days after sight pay to the order of Bank of Australia the sum of pounds five thousand only

To The Importing Co., For The Exporting Co.,

Melbourne London

signature

Please answer, fill in the blanks or make choice of the following questions.

Exchange for GBP5, 000. 00 London, 1 April, 200×

At 60 days after sight pay to the order of Bank of Australia the sum of pounds five thousand only

To The Importing Co., For The Exporting Co.,

Melbourne London

signature

第8题

盈峰资本公募期间历史业绩,正确的是()

A、2014至2018年1季度,A专户组合收益215.09%,在相同时间区间内,在全市场公募产品中排名第一,年复合收益率31%

B、2014至2018年1季度,B专户组合收益185.42%,在相同时间区间内,在全市场公募产品中排名第九,年复合收益率28.29%

C、2014至2018年1季度,同期沪深300累计收益67.89%

D、2014至2018年1季度,同期比较基准年复合收益率为12.67%

第9题

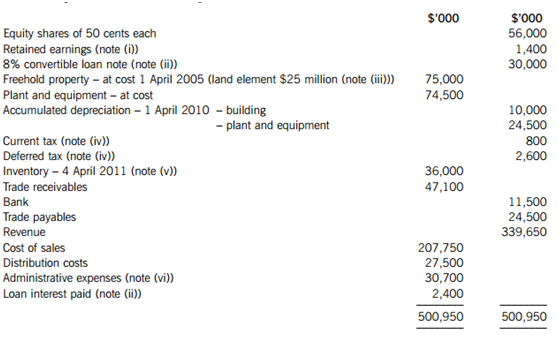

The following trial balance relates to Highwood at 31 March 2011:The following notes are r

The following trial balance relates to Highwood at 31 March 2011:

The following notes are relevant:

(i) An equity dividend of 5 cents per share was paid in November 2010 and charged to retained earnings.

(ii) The 8% $30 million convertible loan note was issued on 1 April 2010 at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par on 31 March 2013 or convertible into equity shares at the option of the loan note holders on the basis of 30 equity shares for each $100 of loan note. Highwood’s finance director has calculated that to issue an equivalent loan note without the conversion rights it would have to pay an interest rate of 10% per annum to attract investors.

The present value of $1 receivable at the end of each year, based on discount rates of 8% and 10% are:

(iii) Non-current assets:

On 1 April 2010 Highwood decided for the first time to value its freehold property at its current value. A qualified property valuer reported that the market value of the freehold property on this date was $80 million, of which $30 million related to the land. At this date the remaining estimated life of the property was 20 years. Highwood does not make a transfer to retained earnings in respect of excess depreciation on the revaluation of its assets.

Plant is depreciated at 20% per annum on the reducing balance method.

All depreciation of non-current assets is charged to cost of sales.

(iv) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2010. The required provision for income tax for the year ended 31 March 2011 is $19·4 million. The difference between the carrying amounts of the net assets of Highwood (including the revaluation of the property in note (iii) above) and their (lower) tax base at 31 March 2011 is $27 million. Highwood’s rate of income tax is 25%.

(v) The inventory of Highwood was not counted until 4 April 2011 due to operational reasons. At this date its value at cost was $36 million and this figure has been used in the cost of sales calculation above. Between the year end of 31 March 2011 and 4 April 2011, Highwood received a delivery of goods at a cost of $2·7 million and made sales of $7·8 million at a mark-up on cost of 30%. Neither the goods delivered nor the sales made in this period were included in Highwood’s purchases (as part of cost of sales) or revenue in the above trial balance.

(vi) On 31 March 2011 Highwood factored (sold) trade receivables with a book value of $10 million to Easyfinance. Highwood received an immediate payment of $8·7 million and will pay Easyfinance 2% per month on any uncollected balances. Any of the factored receivables outstanding after six months will be refunded to Easyfinance. Highwood has derecognised the receivables and charged $1·3 million to administrative expenses. If Highwood had not factored these receivables it would have made an allowance of $600,000 against them.

Required:

(i) Prepare the statement of comprehensive income for Highwood for the year ended 31 March 2011;

(ii) Prepare the statement of changes in equity for Highwood for the year ended 31 March 2011;

(iii) Prepare the statement of financial position of Highwood as at 31 March 2011.

Note: your answers and workings should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(i) 11 marks

(ii) 4 marks

(iii) 10 marks

请帮忙给出正确答案和分析,谢谢!

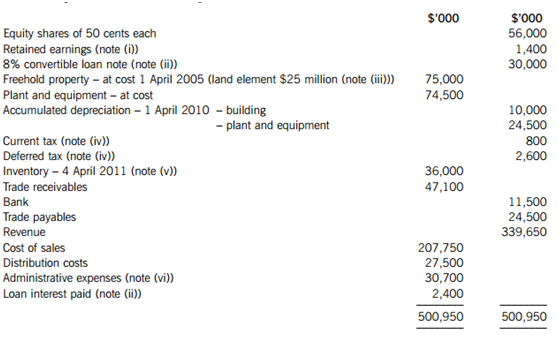

The following trial balance relates to Highwood at 31 March 2011:

The following notes are relevant:

(i) An equity dividend of 5 cents per share was paid in November 2010 and charged to retained earnings.

(ii) The 8% $30 million convertible loan note was issued on 1 April 2010 at par. Interest is payable annually in arrears on 31 March each year. The loan note is redeemable at par on 31 March 2013 or convertible into equity shares at the option of the loan note holders on the basis of 30 equity shares for each $100 of loan note. Highwood’s finance director has calculated that to issue an equivalent loan note without the conversion rights it would have to pay an interest rate of 10% per annum to attract investors.

The present value of $1 receivable at the end of each year, based on discount rates of 8% and 10% are:

(iii) Non-current assets:

On 1 April 2010 Highwood decided for the first time to value its freehold property at its current value. A qualified property valuer reported that the market value of the freehold property on this date was $80 million, of which $30 million related to the land. At this date the remaining estimated life of the property was 20 years. Highwood does not make a transfer to retained earnings in respect of excess depreciation on the revaluation of its assets.

Plant is depreciated at 20% per annum on the reducing balance method.

All depreciation of non-current assets is charged to cost of sales.

(iv) The balance on current tax represents the under/over provision of the tax liability for the year ended 31 March 2010. The required provision for income tax for the year ended 31 March 2011 is $19·4 million. The difference between the carrying amounts of the net assets of Highwood (including the revaluation of the property in note (iii) above) and their (lower) tax base at 31 March 2011 is $27 million. Highwood’s rate of income tax is 25%.

(v) The inventory of Highwood was not counted until 4 April 2011 due to operational reasons. At this date its value at cost was $36 million and this figure has been used in the cost of sales calculation above. Between the year end of 31 March 2011 and 4 April 2011, Highwood received a delivery of goods at a cost of $2·7 million and made sales of $7·8 million at a mark-up on cost of 30%. Neither the goods delivered nor the sales made in this period were included in Highwood’s purchases (as part of cost of sales) or revenue in the above trial balance.

(vi) On 31 March 2011 Highwood factored (sold) trade receivables with a book value of $10 million to Easyfinance. Highwood received an immediate payment of $8·7 million and will pay Easyfinance 2% per month on any uncollected balances. Any of the factored receivables outstanding after six months will be refunded to Easyfinance. Highwood has derecognised the receivables and charged $1·3 million to administrative expenses. If Highwood had not factored these receivables it would have made an allowance of $600,000 against them.

Required:

(i) Prepare the statement of comprehensive income for Highwood for the year ended 31 March 2011;

(ii) Prepare the statement of changes in equity for Highwood for the year ended 31 March 2011;

(iii) Prepare the statement of financial position of Highwood as at 31 March 2011.

Note: your answers and workings should be presented to the nearest $1,000; notes to the financial statements are not required.

The following mark allocation is provided as guidance for this question:

(i) 11 marks

(ii) 4 marks

(iii) 10 marks

请帮忙给出正确答案和分析,谢谢!

第11题

2014 年 3 月 11 日,投资者 A 认购了甲基金发行的乙灵活配置混合型证券投资基金(以下简称乙基金)300 万元,认购费率为 1%,基金份额面值为 1 元。2014 年 3 月 11 日投资者 A 认购的乙基金份额为()份。

A、 3000000.00

B、3030000

C、 2970297.03

D、 2947642.43

大学生认证

大学生认证