请输入或粘贴题目内容

搜题

请输入或粘贴题目内容

搜题

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Consolidated financial statements are presented on the basis that the companies within the group are treated as if they are a single economic entity.

Which of the following are requirements of preparing consolidated financial statements?

(1)All subsidiaries must adopt the accounting policies of the parent in their individual financial statements

(2)Subsidiaries with activities which are substantially different to the activities of other members of the group should not be consolidated

(3)All entity financial statements within a group should normally be prepared to the same accounting year end prior to consolidation

(4)Unrealised profits within the group must be eliminated from the consolidated financial statements

A、(1)and (3)

B、(2)and (4)

C、(3)and (4)

D、(1)and (2)

请帮忙给出正确答案和分析,谢谢!

答案

答案

更多“Consolidated financial statements are presented on the basis that the ……”相关的问题

更多“Consolidated financial statements are presented on the basis that the ……”相关的问题

第1题

A、合并账单 Consolidated Billing

B、成本管理器 Cost Explorer

C、预算 Budgets

D、成本分配标签 Cost Allocation Tags

第2题

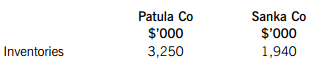

The individual statements of financial position at 31 December 20X5 for both companies show the following:

What will be the total inventories figure in the consolidated statement of financial position of Patula Co as at 31 December 20X5?

A.$5,250,000

B.$5,330,000

C.$5,130,000

D.$5,238,000

请帮忙给出正确答案和分析,谢谢!

第3题

On the assumption that Ambel Co is an associate of Caddy Co, what would be the carrying amount of the investment in Ambel Co in the consolidated statement of financial position of Caddy Co as at 30 September 20X5?

A、$1,560,000

B、$1,395,000

C、$1,515,000

D、$1,690,000

请帮忙给出正确答案和分析,谢谢!

第4题

At 31 March 2015, the retained earnings of Wilmslow and Zeta were $450,000 and $340,000 respectively.

What would be the amount of retained earnings in Wilmslow’s consolidated statement of financial position as at 31 March 2015?

A.$706,000

B.$542,000

C.$498,000

D.$546,000

请帮忙给出正确答案和分析,谢谢!

第5题

At what amount should the non-controlling interests in Square Co be valued in the consolidated statement of financial position of the Pyramid group as at 30 September 20X5?

A、$26,680,000

B、$7,900,000

C、$7,780,000

D、$12,220,000

请帮忙给出正确答案和分析,谢谢!

第6题

Which of the following is an example of an intangible asset of the subsidiary which may be recognised separately from goodwill when preparing consolidated financial statements?

A、A new research project which the subsidiary has correctly expensed to profit or loss but the directors of the parent have reliably assessed to have a substantial fair value

B、A global advertising campaign which was concluded in the previous financial year and from which benefits are expected to flow in the future

C、A contingent asset of the subsidiary from which the parent believes a flow of future economic benefits is possible

D、A customer list which the directors are unable to value reliably

请帮忙给出正确答案和分析,谢谢!

大学生认证

大学生认证